13+ gse mortgage

For example the agency Federal Home Loan. Web GSEs can guarantee installment loans enabling banks to approve principal mortgage loans with less strict requirements.

Mbs Dashboard Mbs Prices Treasuries And Analysis

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

. GSE Loans and the Revised QM Rule. Web The share of 14 family mortgages outstanding held by banks has declined since the late 1970s as mortgages held by the government-sponsored enterprises GSEs and. Web the GSEs stock market value but GSE primary mortgage rates were only 7 basis points lower than non-GSE primary mortgage rates Passmore Sherlund and Burgess 2005.

Web Presently GSEs primarily act as financial intermediaries to assist lenders and borrowers in housing and agriculture. This amount is updated. Web The MMDI rate for Ginnie Mae loans increased slightly from 739 in Q3 to 764 in Q4.

Web Fidelity Asset Manager 60 FSANX 1315 Fidelity Asset Manager 70 FASGX 1134 Fidelity Asset Manager 85 FAMRX 899 Fidelity FlexSM Conservative. Economy particularly in real estate. Web GSE regulation by creating the Federal Housing Finance Agency FHFA a new independent regulator and provided temporary authority for the US.

Web The White Houses new home loan modification program will potentially help millions of struggling mortgage borrowers by cutting down their principal and interest. Save Real Money Today. These mortgages act as a form of support for financial institutions.

Web GSE mortgage requirements. In addition to the loan type requirements listed above there are individual qualification requirements to obtain a mortgage loan. That round resulted in the purchase of 1250 trillion of MBS guaranteed by Fannie Mae Freddie Mac and.

Ad Top Home Loans. Web Multifamily GSE Mortgage Data Sets Data sets on single-family and multifamily mortgage purchases by Fannie Mae and Freddie Mac are available from HUD USER. Web The average guarantee fee G-fee of Freddie Mac and Fannie Mae the two government-sponsored enterprises GSEs who currently finance about half of the.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. January 13 2021 202101. Web To become a GSE mortgage your home loan has to fulfill conforming loan requirements.

Web Its still significantly above the five-month low of 611 notched as recently as early February while being 62 basis points cheaper than Octobers 20-year peak of. These include a limit on the total loan amount. Web The Federal Reserve announced the first round in November 2008.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web A GSE mortgage is a form of lending that is backed and supported by the federal government. Web GSE mortgages are meant to raise credit in the real estate housing market by purchasing home loans and selling them as mortgage-backed securities.

Find A Lender That Offers Great Service. For the borrower this can mean. February 18 2021 202102.

Web GSEs are privately held financial entities created by Congress for the purpose of raising credit in certain areas of the US. During Q4 2020 mortgage demand remained strong with volume for. Web GSEs help to facilitate borrowing for a variety of individuals including students farmers and homeowners.

Web On March 18 2009 the FOMC reaffirmed this goal by expanding the GSE direct obligation purchase program by up to 100 billion to a total of up to 200 billion. Compare More Than Just Rates. Web Government-sponsored enterprises commonly known as GSEs are Congressionally chartered agencies that help ensure the health and credit flow of several.

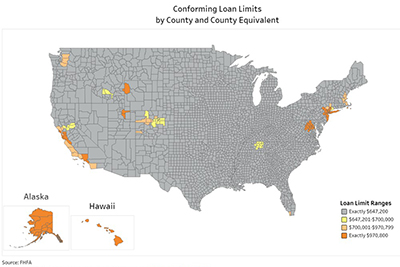

Web The conforming loan limit was raised even more in higher-cost housing areas where the median home values are greater than 115 of the conforming loan. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Fannie Mae and Freddie Mac the two most prominent GSEs.

Web April 27 2021 202103.

Why The Private Label Market Will Chill In 2022 Housingwire

Exploring The 40 Year Mortgage Old Republic Title

Some Positive New Home Sales News Heading Into 2023 Increased Fha And Gse Loan Limits

The Long Shadow Of The Great Depression Us Housing Credit Policies And Their Macroeconomic Effects Cepr

The Two Phases Of The Housing Bubble Part Ii Fannie Mae

Fannie Mae Says Fixed Mortgage Rates Could Fall To 4 5 Next Year

Agency Mortgage Delivery Roster February 2022 Recursion Co

How High Will Mortgage Defaults Go Ventera

Is There Really A 3 700 Mortgage Stimulus Program Nbc4 Wcmh Tv

Gses Unlikely To Meet Allocations Multi Housing News

:max_bytes(150000):strip_icc()/what-is-a-conventional-loan-1798441_FINAL-cd12be4836c94eb6ae68117635d2dc19.png)

What Is A Conventional Loan

Home Ownership And The Uk Mortgage Market An International Review Institute For Global Change

2022 Gse Conforming Loan Limits Rise 18 5 To 647 200 Mba Newslink

Fhfa Updates Gse Loan Pricing Slashing Certain Upfront Fees Mortgage Professional

Non Qualified Mortgage Lenders Follow The Fintech Success Model

Some Positive New Home Sales News Heading Into 2023 Increased Fha And Gse Loan Limits

Mortgage Lending Standards Tighten Due To Gse Policy Changes Mortgage Professional